Liquidity

What is Liquidity and what is a liquidity security is very hard to define in practice. Liquid security can be traded very quickly (quick execution), has very little price impact (low slippage), can be bought and sold in large quantities (deep order book).

There are 2 ways to measure liquidity:

- Volume-based: trading volume, turnover = Trading volume / Shares outstanding

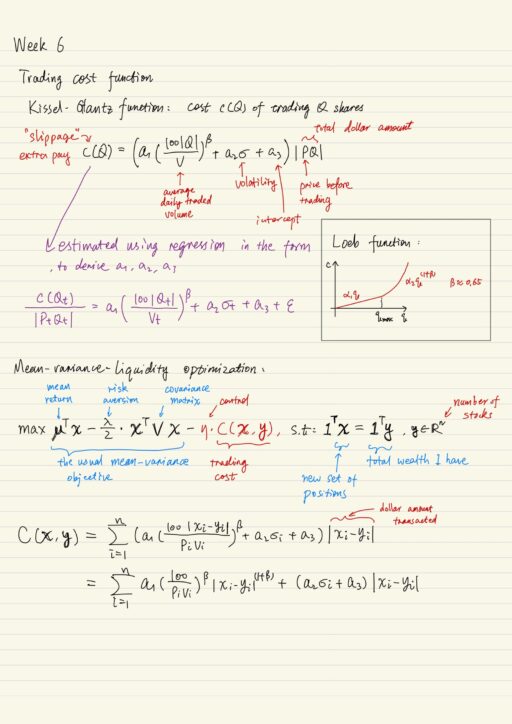

- Cost-based: Percentage bid-ask spread, Volume weighted average price (VWAP), Loeb price impact function, Kissel-Glantz price impact function

Trading cost function which computes the cost of creating a particular block of shares, is typically assumed to be separable across assets, which means that it ignores the cross asset price impact, but in practice this assumption is not valid.

Once we have a price impact function, we can include that into our portfolio selection problem.

Liquidity and Portfolio Selection

There are 2 approaches, the best in practice is to do both:

- Do usual portfolio selection and account for liquidity in executing trades

- Incorporate liquidity concerns directly into portfolio selection, you are choosing positions that will have low cost of execution.

You take your usual mean-variance optimization problem, with Kissel-Glantz impact function incorporated. There is also another easy approach introduce by Andy Lo et al. What they do, is they ascribe to each security a certain normalized liquidity measure. A single measure of liquidity implies more liquidity where values are high (for example: high turnover, high volume, in the case of bid-ask spreads, you take the reciprocal of them).

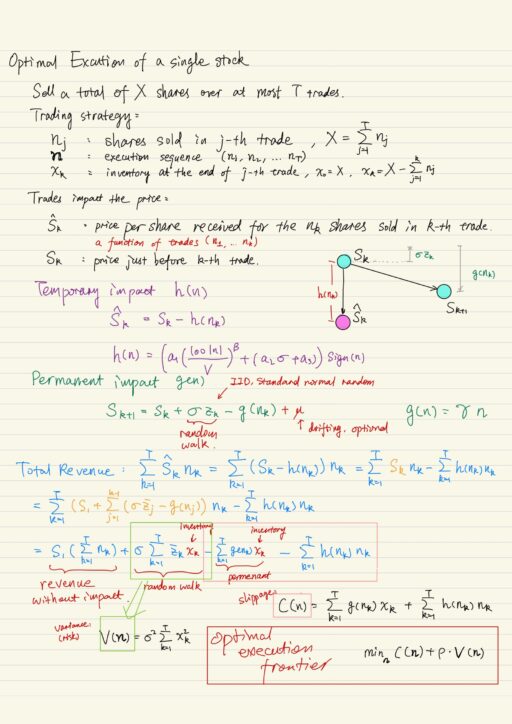

Optimal Execution of a Single Stock

Suppose we have to sell a total of X shares over at most T trades. We want to sell these shares in order to have the least amount of trading cost associated with it. We are going to assume the impact on the price of trades is going to have 2 components:

| Temporary price impact h(n) | impact of a trade nk on its own price per share S^k |

| Permanent price impact g(n) | impact of a trade nk on future prices S^l, l > k |

Optimal execution frontier is the trade of between expected cost and risk.

minn C(n) + ρ * V(n)If we completely ignore variability, then the best thing to do is to sell equally across the entire time horizon. That minimizes the amount that we sell on any give day and therefore minimizes the price impact C(n). Meanwhile we expose our inventory to very high variability V(n). Therefore the realized revenue could be far away from the expected revenue.

If we want to control the variability V(n), then I want to sell quickly, but then we will pay a cost in the expected slippage C(n). So we need to balance between C(n) and V(n). The ρ is used to explore the different points on the surface.

Portfolio Execution

You have a portfolio with position x ( x ∈ Rn ), you want to move to position y ( y ∈ Rn ), over a certain number of trades T. There are various decisions one has to make:

- Trade horizon T is variable, the strategy and model used will be different.

- Effect of cross-asset price impact

- Trade off between market orders (execute immediately) and limit orders (execute at a better price)

- Impact of dark pools

- Want portfolio being balanced.

Cross-assets price impact

This is the trades in one asset influences the prices of other even unrelated assets. The typical economic model is:

- Market-makers, who are often assumed to be less informed about the prices and fundamental values of these assets as compared to speculators in these assets, attempt to learn the fundamental value of one asset from order flow of related assets.

- Speculators strategically trade in several assets in order to reduce trading costs, manage risks and direct price impact, because of these above, the order flow in these assets are correlated.

- Market-makers then look at these correlated order flows and try to set prices, which start reacting to order flows.

Cross-assets price impact is usually negative. Both direct and cross-assets price impact are smaller when speculators are numerous. It is greater when market wide dispersion of belief is higher. It is typically greater among stocks dealt by the same specialist.

Market orders vs limit orders

A limit book is a database that keeps orders: buy orders (bid), sell orders (offer) on price-time-priority basis.

| Market order | picks up orders from the limit order starting from the bid or offer price. immediate execution low revenue from selling or high cost for buying |

| Limit order | places orders on the order book at a specified price execution time is uncertain high revenue from selling or low cost for buying |

Dark pools

Dark pools of liquidity are venues where blocks of share may be bought or sold without revealing either the size or identity of the trade until the trade is filled. By contrast, regular exchange is called Lit Pools, they are transparent, you can see the limit book.

Consequently, dark pools trading avoiding market impact. But they are recently attracted controversy:

- It impacts price discovery in lit pool, and publicly traded prices may no longer ‘fair’

- It has winners’ curse problem – they could have bought a large block of stock in lit pool at a lower better price. But seller would not come to lit pool if they have a large block to sell.

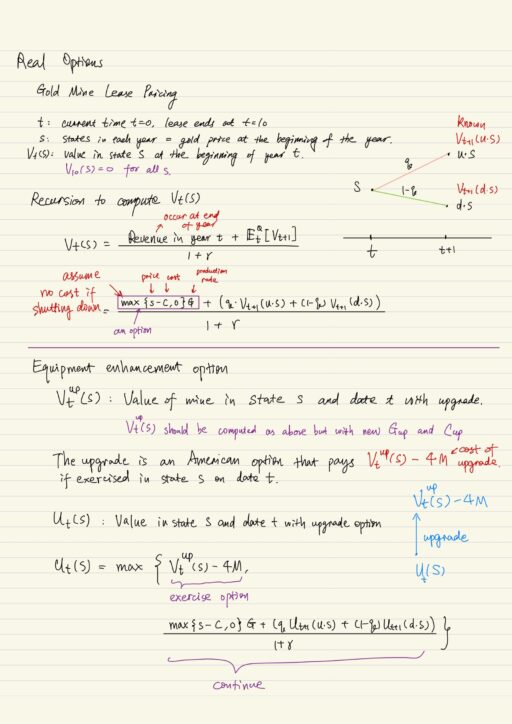

Real Options

Option theory can be used to value operations with built-in optionality, so used to evaluate non-financial investment and decision problems. Some examples are valuation of a lease of a gold mine, an equipment upgrade, drug development, facility contracting, tolling contract and gas stations.

The real options paradigm wants to view a project as having many sources of uncertainty:

- Market uncertainty: price demand

- Industry uncertainty: merger & acquisitions, innovations

- Technical uncertainty: research and development

- Organizational uncertainty: key personnel

- Political uncertainty: regulations, wars

The real options paradigm wants to manage these uncertainties by adding flexibility to projects or companies via options. Project management in this paradigm is all about flexibility.

My Certificate

For more on Liquidity, Portfolio Execution, Real Options, please refer to the wonderful course here https://www.coursera.org/learn/financial-engineering-2

Related Quick Recap

I am Kesler Zhu, thank you for visiting my website. Checkout more course reviews at https://KZHU.ai

Don't forget to sign up newsletter, don't miss any chance to learn.

Or share what you've learned with friends!

Tweet