Pricing Defaultable Bonds and Credit Default Swap

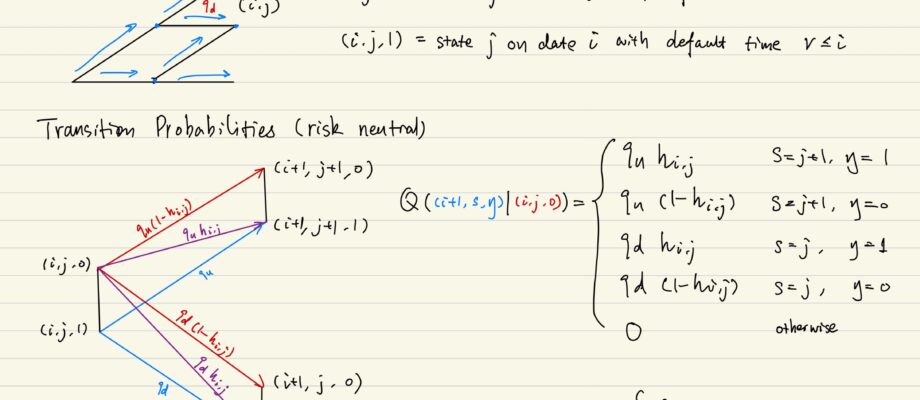

Defaultable Bonds A defaultable bond has these characters: We have to specify the probability of default by working directly with risk-neutral probability Q. We will model the term structure of default using 1-step default probability h(t). As with other fixed income securities, we are going to calibrate h(t) to market prices. We will need to … Continue reading Pricing Defaultable Bonds and Credit Default Swap

0 Comments