Defaultable Bonds

A defaultable bond has these characters:

- coupon payment c

- face value F

- recovery value R (random fraction of F, recovered on default)

We have to specify the probability of default by working directly with risk-neutral probability Q. We will model the term structure of default using 1-step default probability h(t).

As with other fixed income securities, we are going to calibrate h(t) to market prices. We will need to modify lattice to include defaults. In Binomial lattice, we add a new variable to nodes (i, j) denoting whether or not the default has happened before time i (inclusive).

Defaultable zero-coupon bonds

Debatable zero-coupon bonds with expiration T and no recovery on default:

- if no default has occurred at any time t <= T, it pays $1 at the expiration time T (in any state)

- if default has occurred at any time t <= T, it pays 0 (there is no recovery)

The price of a defaultable zero-coupon bond is set by discounting expected value of ri,j plus hi,j. So hi,j is interpreted as credit spread, because:

- if the bond is not defaultable, then I would have discounted only by ri,j

- since the bond is defaultable, I am going to discount the price by extra interest rate, which is hi,j

The conditional probability of default hi,j is also called hazard rate.

Defaultable coupon-bearing bonds

We assume the hazard rate hi,j is state independent, which ensures the default probability is independent of the interest rate dynamics. So hi,j = hi. Let’s define q(t) as the risk-neutral probability that the bond survived until time t. Let I(t) denotes the indicator that the bond survives up to time t, then indicator that default in time t is I(t -1) – I(t). From the definition of I(t), it immediately follows that the expected value, under the risk-neutral measure, of I(t) is equal to p(t). Once we have this indicator variable I(t), we can define various events using it.

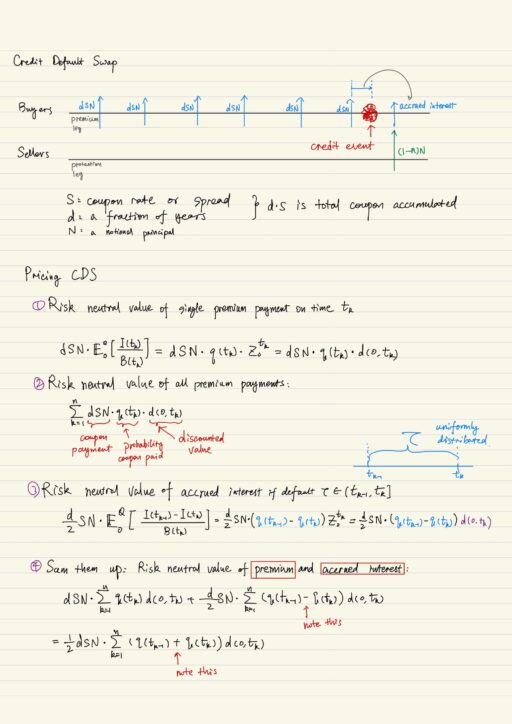

Basics of Credit Default Swaps

The sellers of a credit default swap agrees to compensate a buyer, in the event of loan default (or some other credit event) on a reference entity (corporate or sovereign), in return for periodic premium payments. So there is a certain amount of principal that has been protected, in order to protect that principal, you have to pay a spread (or a coupon, S) times the principal (N) every a fraction of years (d).

The details behind CDS is enormous. The reason is there are many difficult issues, like how do we define ‘credit event’ has occurred? and how to determine recovery rate?

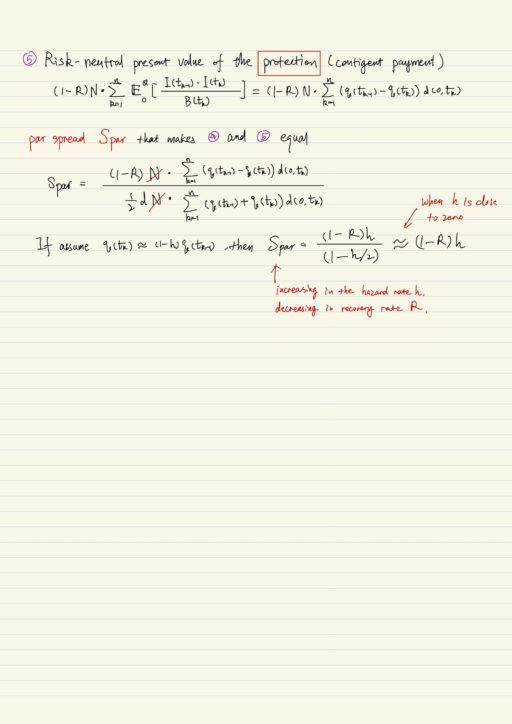

CDS spread S is approximately (1-R)*h, where R is recovery rate, and h is hazard rate. If R is fixed, the spread is directly proportional to the hazard rate h. And hazard rate is conditional probability of default. So you will end up getting conditional probability of default is approximately equals to S / (1-R). CDS spreads react news events.

CDS was initially developed for hedging. They allow to hedge concentrations of credit risk privately. CDS can be written pretty much on anything, it is a contract, not a bond or cash bond. Therefore you can use this construct to hedge against situations where bond or publicly treated debts are not available.

Also CDS is very different from insurance contract. CDS can be written to cover anything, you can buy protection even you don’t hold any underlying debt. In some cases, speculation became the main application. CDS has provided an unfunded way to create credit risk. When you have a negative view in a market, you can buy protection, which is often easier than shorting the assets.

CDS has been blamed for financial crisis and debt crisis. CDS positions are not transparent, they don’t need to show up in balance sheet, it threatened the trust in all counter parties. Since no one knew who faced losses when a crisis event happens, all the counter parties were suspect and entire trading came to a halt. CDS were traded in a OTC market, it is impossible for any dealer to know what a previous deal had made, resulting in the situation where lots of CDS could be made without enough collateral. The interconnected obligations of dealers led to worries about contagion. CDS have played their role and will continue to be risky part of economy.

Pricing CDS

The value of CDS to buyer is the risk-neutral value of protection minus the risk-neutral value of premium. Par spread is defined to be the spread that makes the contract value equal to zero.

My Certificate

For more on Pricing Defaultable Bonds and Credit Default Swap, please refer to the wonderful course here https://www.coursera.org/learn/financial-engineering-1

Related Quick Recap

I am Kesler Zhu, thank you for visiting my website. Checkout more course reviews at https://KZHU.ai