Corporate strategy is really about 2 things: Corporate headquarters are important because they are the place where corporate strategy is made, but they are ultimately responsible for ensuring corporate advantage. Often time in headquarters you will find corporate management functions like treasury, risk management, taxation, financial reporting, legal counsel, etc. These are often referred to…

Category: Quick Recap

Corporate Strategy: Divestiture

Divestiture is exiting from a business, it is the opposite of diversification. Outsourcing is also different from divestiture. Divestiture is when you exit the entire value chain. Outsourcing is when you exit only part of the value chain. Modes of Divestiture There are a few basic modes: Sell-off another company would buy your business,opposite of…

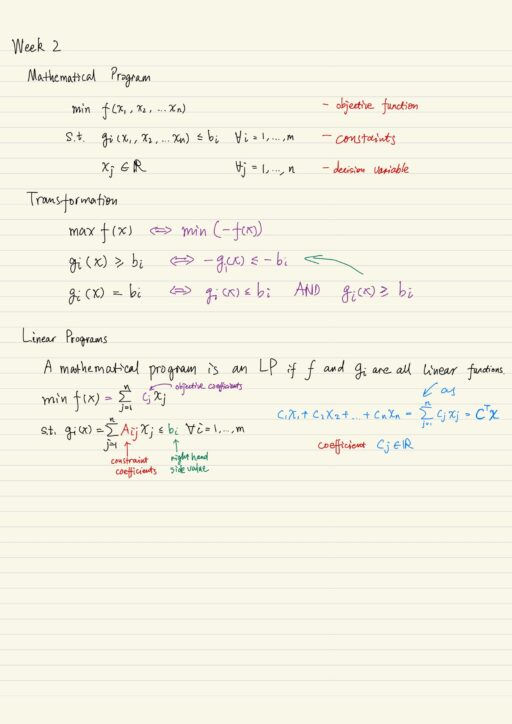

Operations Research: Linear Programming

Almost all of problems that Linear Programming is able to solve is about resource allocation, for example: product mix, production, inventory, scheduling, etc. You have limited resource, and so many things to do. So that you have decision-making problems. Linear program is a special type of mathematical program with some special properties. Mathematical Programs Basically,…

Data Science Team

Data science is a team sport. D. J. Patil Team Sport The team includes data scientists, managers, data engineers who develop and perform the infrastructure, people have contact with outside, etc. The positions include: Data engineer Build and administrate databaseBuild production level algorithms, and implement them on serversHave skills in infrastructure development Data scientist Do…

Risk Management: Equity Derivatives in Practice

Review of Self-Financing Trading Strategy A self-financing trading strategy is a trading strategy θt = (xt, yt) where changes in Vt are due entirely to trading gains or losses, rather than the addition or withdrawal of cash funds. Why do we care? Dynamic Replication: in the multi-period binomial model, we can actually construct a self-financing…

Financial Markets Week 1

Measure of Risks VAR means variance. The variance of a portfolio is defined as a measure of its viability. VaR means Value at Risk, is used by some finance people to quantify risk of an investment or portfolio. It is usually quoted in dollars for a given probability and time horizon. Stress test is another…

Corporate Strategy: Diversification

Diversification is entering a new business. When you think about entering a new business, there are 3 type of questions you should ask about diversification: Basic modes If you are thinking about diversification, the main choices are described by the growth tree: The continuum of relationship between firms is used. On one hand is Arm’s…

Fashion & Luxury Business Models

Market Segments There are different market segments in which fashion and luxury companies complete. The most common criterion to segment a market is price, which leads to the so-called fashion pyramid, which is the reference for everyone in the industry to position its brand. Different brands (even from the same company) occupy different market segments…

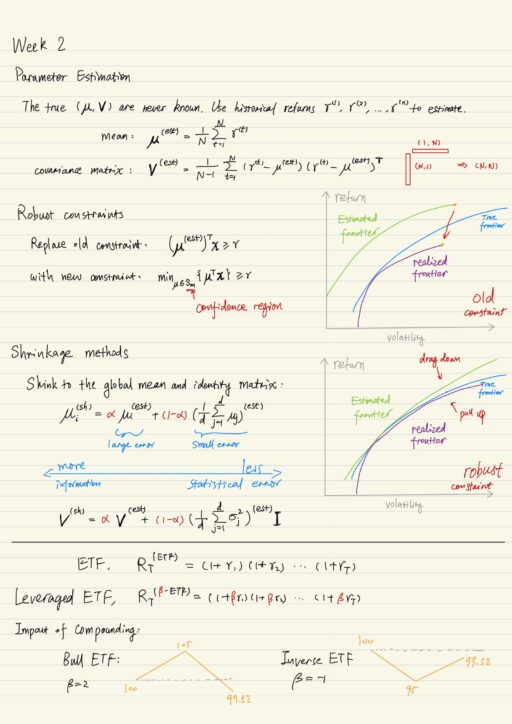

Financial Engineering: Implementing Mean-Variance

There are many aspects of implementation details of mean-variance. 3 of them are the most important. Parameter estimation The estimated mean can be very far away from the true mean. True mean can lie in an ellipse with a certain probability. Parameter error is usually very serious for mean-variance portfolio selection. There is usually a…

Everyday Leadership

What is Leadership Leadership is not just about formal authority, it is really about influencing others. Today’s business environment is fast – things happen very quickly, you have to react quickly. Technology has made it faster to connect to people anywhere in the world, that can bring customers but also competitors. Agility is a social…

Introducing Operations Research

Motivations Management is the attainment of organizational goals in an effective and efficient manners through planning, organizing, leading, and controlling organizational resources. Daft R. L. (2014) Management When you run a company or an organization, you want to do something, that is your goal, but you have limited resources, you want to assign or allocate…

Assets & Portfolios: Mean-Variance Optimization

Assets and Portfolios I’ve got a certain amount of money, I want to split it among various assets available for investment. An asset can be characterized by price and return, both of them are random. wi is the amount of money in asset i; wi > 0 means long investment, wi < 0 means short…

Corporate Strategy: Sum-of-the-Parts Analysis

What is Corporate Strategy? Corporate strategy is strategy that firms use to compete across multiple businesses. It is relevant for 2 groups of firms: multi-business firms and single-business firms that think about extending into a new business. Having different strategy for different business is not sufficient. A business vary by both corporation and industry, but…

Mortgage Backed Securities

Mortgage based securities are a particular kind of asset-based securities. They are asset-backed by underlying pools of securities like mortgage, auto / student loans, credit card receivable, and so on. The process by which asset-based or mortgage-based securities are created is called securitization. By securitizing, we enable the sharing and spreading of risk. There are…

Data Science for Executives

Data science is only useful when the data are used to answer a specific, concrete question that could be useful for your organization. Data science is the process of: There is actually data science learning from data, discovering what is the right prediction model is. And there is implementation lumped into data engineering to scale…