Mortgage based securities are a particular kind of asset-based securities. They are asset-backed by underlying pools of securities like mortgage, auto / student loans, credit card receivable, and so on. The process by which asset-based or mortgage-based securities are created is called securitization. By securitizing, we enable the sharing and spreading of risk. There are many different kind of mortgages, any of them can be used to construct mortgage-backed securities. Some examples are:

- level-payment mortgages: constant payment is paid every month, until the end of the mortgage

- adjustable-rate mortgages: mortgage rate is reset periodically, big role in subprime crisis

- balloon mortgages

- many others

Level-Payment Mortgage

Level-payment mortgage assumes equal periodic payments, and a coupon rate (interest rate) per period. There are total of n payment period, and after n payments, both mortgage principal and interests have all been paid. Then the mortgage is said to be fully amortizing.

Assuming a deterministic world with no possibility of defaults and prepayments, we could compute the present value of the mortgage. In any time period, we can also easily break down the payment into a scheduled principal payment and a scheduled interest payment. This observation can be used to create principal-only and interest-only mortgage based securities.

Pre-payment Risk

Mortgage holders or homeowners often have an option to prepay their mortgage early. Payments made in excess of the scheduled payments are called prepayments. This usually happens when homeowners want to:

- sell their home

- refinance their mortgage at a better interest rate

- default on their mortgage payments

- home destroyed by flooding, fire (insurance proceeds will prepay the mortgage

The pre-payment risk refers to the risk that is created by the homeowner to the investors in mortgage-based securities. So prepayment modeling is therefore an important feature of pricing mortgage-based securities. And the value of some mortgage-based securities is extremely dependent on prepayment behavior.

Mortgage Pass-throughs

In practice, mortgages are often sold on to third parties (eg. Freddie Mac, Fannie Mae) who can then pool these mortgages together to create mortgage-based securities. The modeling of MBS therefore depends on whether they are agency or non-agency MBS.

A mortgage pass-through is the simplest example of a mortgage-backed security, where a group of mortgages are pooled together. Investors in this MBS receive monthly payments representing the interest and principal payments of the underlying mortgages. Here are some important definitions and conventions:

| pass-through coupon rate | strictly less than the average coupon rate of underlying mortgages |

| weighted average coupon rate (WAC) | weighted average of the coupon rates in the mortgage pool with weights equal to mortgage amounts still outstanding |

| weighted average maturity (WAM) | weighted average of the remaining months to maturity of each mortgage in the mortgage pool with weights equal to the mortgage amounts still outstanding |

| conditional prepayment rate (CPR) | the annual rate at which a given mortgage pool prepays. It is expressed as a percentage of the current outstanding principal level in the underlaying mortgage pool. It tells you what percentage of the outstanding mortgage at the beginning of the period will be prepaid. |

| single-month mortality rate (SMM) | the CPR converted to a monthly rate assuming monthly compounding. SMM = 1 – (1-CPR)1/12 CPR = 1 – (1-SMM)12 |

Prepayment Conventions

In practice, CPR is stochastic and depends on the mortgage pool and other economic variables. However market participant often use a deterministic prepayment schedule as a mechanism to quote MBS yields and so-called option-adjusted spreads. The standard benchmark is the Public Securities Association (PSA) benchmark. PSA benchmark assumes CPR as follows:

- CPR = 6% * (t/30), if t ≤ 30

- CPR = 6%, if t > 30

- where t is the number of months since the mortgage pool originated

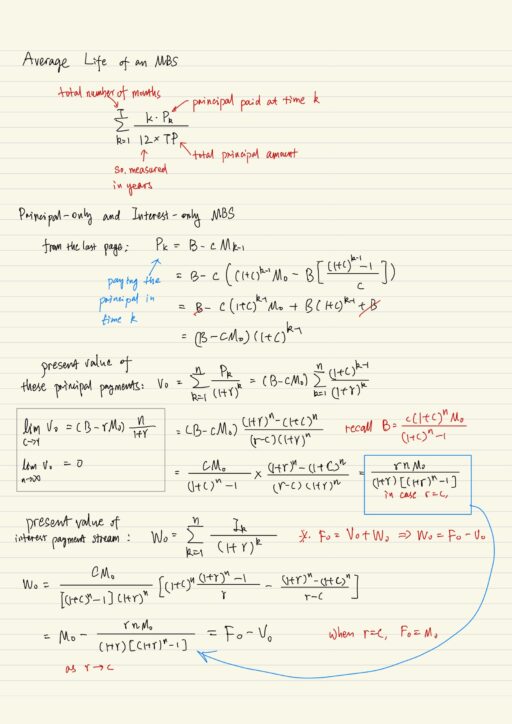

Slower or faster prepayment rates are then given as some percentage or multiple of PSA. The average life of an MBS decreases as the PSA spreed increases. Because if the PSA speed increases, you are going to get more of your principal payments earlier in the life of the mortgage.

Mortgage Yields

In practice the price of a given MBS is observed in the market place and from this a corresponding yield-to-maturity can be determined. This yield is the interest rate that will make the present value of the expected cash flows equal to the market price. The problem with mortgage backed securities is that the cash flow is uncertain due to prepayments. So when you are calculating yield-to-maturity for mortgage backed securities you have to fix the cash flow, the way to fix it is to make some assumption about prepayments.

So the expected cash flow are determined based on some underlying prepayment assumptions such as 100 PSA, 300 PSA, etc. So any quoted yield must be with respect to some prepayment assumptions. When the yield is quoted as an annual rate based on semi-annual compounding, it is called a bond-equivalent yield.

Yields actually are very limited when it comes to evaluating a mortgage-backed security and fixed income securities in general, because it does not take the term structure of interest rates, or prepayment option into account. So the market place typically uses option-adjusted spreads (OSA) as market standard for quoting yields in MBS, and other fixed income securities with embedded options.

Contraction Risk and Extension Risk

An investor in an MBS pass-through is of course exposed to interest rate risk in that present value of any fixed set of cash flow descreases as interest rates increase. However they are also exposed to prepayment risks, they are:

| contraction risk | when interest rates decline, prepayments tend to increase (homeowner refinance), and the additional prepaid principal can only be invested at lower interest rate. |

| extension risk | when interest rates increase, prepayments tend to decrease, and so there is less prepaid principal that can be invested at the higher rate. |

Principle-only MBS and Interest-only MBS

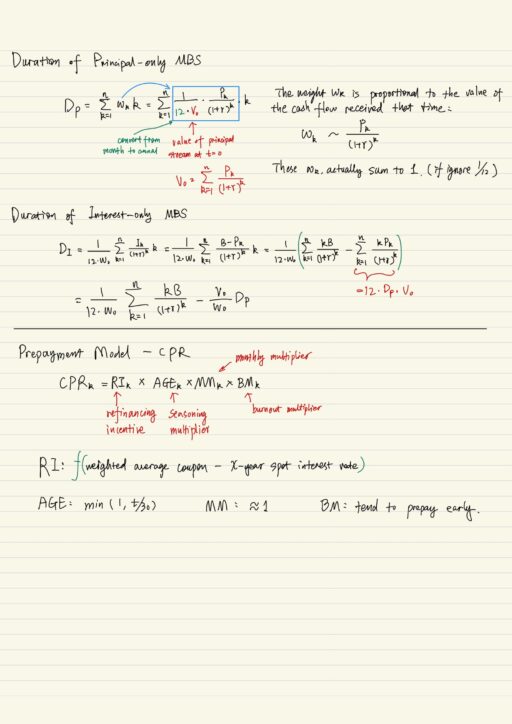

Principle-only MBS is constructed from the principal payments of the underlying pool, and Interest-only MBS is constructed from the interest payments in the underlying pool. They have very different exposures to prepayment risks. The risk can be measured by the concept called duration.

The duration of a cash flow is a weighted average of times at which each component of the cash flow is received, this is a standard measure of the risk of a cash flow. The principal stream has a longer duration than the interest stream.

Duration tells us how long on average we have to wait until we receive the cash flows from that stream. The longer the duration, the more risky the cash flow is, because there is more uncertainty.

In practice, pass-throughs do experience prepayments, the mortgage balance at the end of period k Mk now must be calculated iteratively on a path-by-path basis:

Mk = Mk-1 – ScheduledPrincipalPaymentk – Prepaymentk, for k = 1,…,n

Finally the risk profile of principal-only and interest-only securities are very different from one another, even though they are constructed from the same underlying pool of mortgage. The principal-only investor would like prepayments to increase, meanwhile interest-only want prepayments to decrease.

Collateralized Mortgage Obligations (CMO)

CMOs are a class of mortgage backed securities that have been created by redirecting the cash flows from other mortgage securities, mainly to mitigate prepayment risk and create securities that are better suited to potential investors. CMOs can be created from

- pools of mortgages, or

- pass-through securities, or

- other mortgage backed securities, etc

There are many types of CMOs including:

- sequential CMOs

- CMOs with accrual bonds

- CMOs with floating-rate and inverse-floating-rate tranches

- planned amortization class (PAC) CMOs

Sequential CMOs

The basic structure of a sequential CMO is that there are several tranches which are ordered in such a way that they are retired sequentially. For example, the payment structure of a sequential CMO with tranches A, B, C and D. On each tranche, the interest will be paid to the investor in each tranche in every period. But principal will not be paid to the holders for each tranche. All of the principal payments will go towards paying tranche A investors, and only when tranche A’s principal has been paid off entirely, will the principal payments from the underlying mortgage pool be used to pay tranche B. Then C, and D. We are actually creating 4 new securities: tranche A, B, C and D, in such a way that there is more certainty around when these tranches will get their payments.

Prepayment Modeling

Prepayment model is the most important feature of any residential mortgage backed security pricing engine. Term structure models, which are also required to price mortgage backed securities, are well understood in financial engineering community, but it is not true in prepayment models.

A mortgage backed security is exposed to both:

- interest rate risk – why you need a term structure model

- prepayment risk – why you need a model of prepayment

There is relatively little publicly available information concerning prepayment rates. It is very difficult to construct good accurate prepayment models. One well known model is CPR conditional prepayment rate.

We also need to specify term structure model (binomial, Black-Scholes, Ho-Lee, etc), which is used to:

- discount all of the MBS cash flows in the usual risk-neutral pricing framework

- compute the refinancing incentive

It is important that we are able to compute the relevant interest rates analytically, for example the x-year spot interest rate r10(k). Such a model would first need to be calibrated to the term structure of interest rates in the market place as well as liquid interest rate derivative securities (like caps, floors, swaptions, etc).

The actual pricing of mortgage backed securities requires Monte Carlo simulation (very computationally intensive), and analytics prices are not available.

My Certificate

For more on Mortgage Backed Securities, please refer to the wonderful course here https://www.coursera.org/learn/financial-engineering-1

Related Quick Recap

I am Kesler Zhu, thank you for visiting my website. Checkout more course reviews at https://KZHU.ai