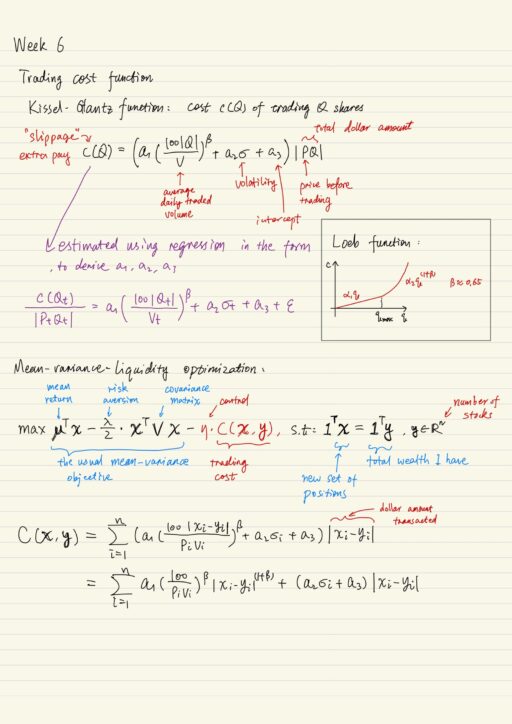

Liquidity What is Liquidity and what is a liquidity security is very hard to define in practice. Liquid security can be traded very quickly (quick execution), has very little price impact (low slippage), can be bought and sold in large quantities (deep order book). There are 2 ways to measure liquidity: Trading cost function which…

Financial Statement: Company Position

The financial statements are a manifestation of accounting, which is what we use to prepare proper financial statements. Accounting is fundamentally about measurement, which is the assigning of numerals or other symbols to present the magnitude of an attribute of a phenomenon. Phenomenon represents an object of interest. Attribute represents the characteristics of the phenomenon….

Financial Markets Week 2

It takes long for ideas to develop. We might be excessively fearful or unwillingly to change. Risk management has a history of thousands years, it is a technology that has been very slow to develop. There is an inherent conservatism and mistrust of new financial arrangements. Financial innovation is a pillar of our civilization. People…

Credit Derivatives and Structured Products

Securitization Securitization is the process of constructing new securities from the cash flows generated by a pool of underlying securities. The economic rationale behind securitization is that it enables the construction of new securities with a broad range of risk profiles. A board range of investors may therefore be interested in these new securities even…

My #67 course certificate from Coursera

Getting started with TensorFlow 2Imperial College London Wow this is a wonderful course on Tensorflow! The professor and lecturers directly teach how to write code to complete certain tasks, piece-by-piece and step-by-step. Upon the moment of completing all programming assignments you would certainly gain Tensorflow skills and be confident in your next real job. You’d…

Corporate Strategy: Headquarters

Corporate strategy is really about 2 things: Corporate headquarters are important because they are the place where corporate strategy is made, but they are ultimately responsible for ensuring corporate advantage. Often time in headquarters you will find corporate management functions like treasury, risk management, taxation, financial reporting, legal counsel, etc. These are often referred to…

Corporate Strategy: Divestiture

Divestiture is exiting from a business, it is the opposite of diversification. Outsourcing is also different from divestiture. Divestiture is when you exit the entire value chain. Outsourcing is when you exit only part of the value chain. Modes of Divestiture There are a few basic modes: Sell-off another company would buy your business,opposite of…

My #66 course certificate from Coursera

Building a Data Science TeamJohns Hopkins University This is a short but instructive course about how a data science team plays as a whole. A data science team appears similar to other kinds of research or development teams, after completing this course you definitely will notice it has its own peculiar characteristics. You probably will…

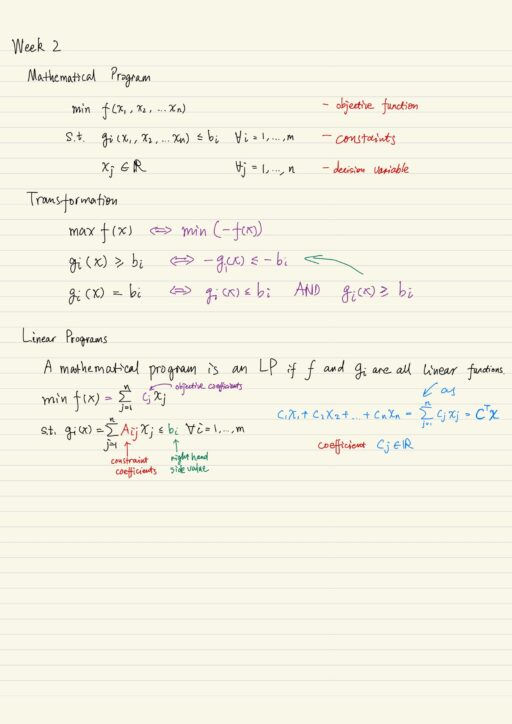

Operations Research: Linear Programming

Almost all of problems that Linear Programming is able to solve is about resource allocation, for example: product mix, production, inventory, scheduling, etc. You have limited resource, and so many things to do. So that you have decision-making problems. Linear program is a special type of mathematical program with some special properties. Mathematical Programs Basically,…

Data Science Team

Data science is a team sport. D. J. Patil Team Sport The team includes data scientists, managers, data engineers who develop and perform the infrastructure, people have contact with outside, etc. The positions include: Data engineer Build and administrate databaseBuild production level algorithms, and implement them on serversHave skills in infrastructure development Data scientist Do…

Risk Management: Equity Derivatives in Practice

Review of Self-Financing Trading Strategy A self-financing trading strategy is a trading strategy θt = (xt, yt) where changes in Vt are due entirely to trading gains or losses, rather than the addition or withdrawal of cash funds. Why do we care? Dynamic Replication: in the multi-period binomial model, we can actually construct a self-financing…

Financial Markets Week 1

Measure of Risks VAR means variance. The variance of a portfolio is defined as a measure of its viability. VaR means Value at Risk, is used by some finance people to quantify risk of an investment or portfolio. It is usually quoted in dollars for a given probability and time horizon. Stress test is another…

Corporate Strategy: Diversification

Diversification is entering a new business. When you think about entering a new business, there are 3 type of questions you should ask about diversification: Basic modes If you are thinking about diversification, the main choices are described by the growth tree: The continuum of relationship between firms is used. On one hand is Arm’s…

Fashion & Luxury Business Models

Market Segments There are different market segments in which fashion and luxury companies complete. The most common criterion to segment a market is price, which leads to the so-called fashion pyramid, which is the reference for everyone in the industry to position its brand. Different brands (even from the same company) occupy different market segments…

My #65 course certificate from Coursera

Foundations of Everyday LeadershipUniversity of Illinois at Urbana-Champaign To some, leadership is an advantage; meanwhile to some, leadership is a problem. This is a wonderful course elaborates what leadership is all about from theoretical perspective. It guides you to find the secrets why some people is so good at being a leader. To me, this…