Overview of Gains and Losses At a very high level, it’s important to be able to calculate the gain or loss upon selling or exchanging an asset. Because, of course, gains are taxable and losses are deductible. That is, these kinds of property transactions will affect a business owners tax liability. In general, how do…

Category: Finance

Depreciation, Amortization and Depletion

Cost Recovery What is cost recovery? For accounting purposes, businesses must capitalize the cost of assets, if the asset’s useful life is more than one year. Capitalization means that the cost of the asset purchase must show up on the balance sheet rather than as an expense on the income statement. What happens later is…

Basics of Bonds, Stocks, and Dividends

Interest Rates Saving Accounts After the financial crisis of 2008 and 2009, the current economic situation is rather different from the past, say 1980s. At that time, banks offered passbook savings account with a 7.4 per annum interest rate. Usually the service has a term in the fine print, for example the stated term is…

My #98 course certificate from Coursera

Startup Valuation MethodsDuke University Hey, new business owners, this wonderful course is for you! You probably have already learned a lot about financing and accounting, you already know how to prepare tax and negotiate with banks. But this course offers one more perspective: how much is your business worth in the eyes of investors? Or…

Venture Capital and Angel Investors

Source of Capital for Startups First of all, there are 2 critical lessons to remember: Imagine you’re the entrepreneur, now the question is what is the right source of capital based on the characteristics of your business? The options include: Another way to look at this decision is to think about it in terms of…

Basics of Valuation

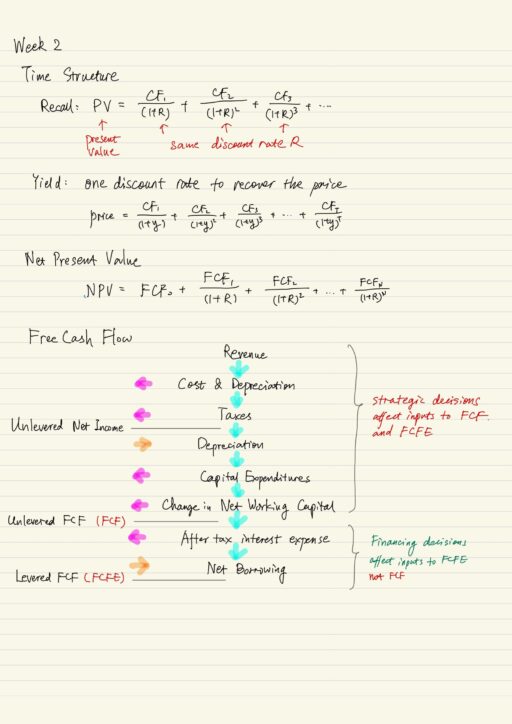

How do markets and investors determine the valuation of a company? There is a framework that financial markets used to think about value, which forms the basis of all modern financial markets. We will think of the price of an asset as being given by the present value of all of the future cash flows…

My #89 course certificate from Coursera

Federal Taxation I: Individuals, Employees, and Sole ProprietorsUniversity of Illinois at Urbana-Champaign I believe taxation is the negotiation between the governors and the governed. Yep, most of people don’t like taxes, however it is really rewarding if you know how the intricacies work. This is an “WOW” course that deserves your attention. Lots of stuff…

Itemized Deductions and Retirement Plans

Recall that the itemized deductions are also called “from AGI” deductions or below the line deductions. They are usually more personal in nature, including medical, taxes, interest and charitable, and not related to running a trade or business. It only provide a tax benefit to the extent, in total, they exceed the standard deduction amount….

Business Deductions

Employees vs Self-Employed What differentiates an employee from a self-employed individual (also known as independent contractor)? Employee If a person is subject to the will and control of another with respect to what job shall be done and how it shall be done. Then that person is more likely to be considered an employee rather than a self-employed…

Tax Deductions for Business, Hobby & Rental

Deductions are essentially the tax word for expense that can reduce the tax base. Deductions are disallowed unless a specific provision permits them. Deductibility depends on “legislative grace”. That is what Congress has decided to legislatively decree what is an allowable expense that can reduce the tax base. As a result, deductions are defined quite narrowly….

Gross Income for Individuals

Gross Income Gross income is all income from whatever source defined, it includes income realized in any form whether in money, property or services. If receive property or services, use Fair Market Value. Taxpayer recognize gross income when: They receive an economic benefit Increase in net worth (assets minus liabilities) Borrowed funds represent a liability,…

My #75 course certificate from Coursera

Introduction to Corporate FinanceUniversity of Pennsylvania Corporate finance is complex. If there is a Big Bang Theory for it, I believe the “infinitely hot and dense single point” definitely will be “the time value of money”. This fantastic course, starting from this point, introduces all the basic concepts you need. Inflation, interest rates, time structures,…

My #74 course certificate from Coursera

Understanding Financial Statements: Company PerformanceUniversity of Illinois at Urbana-Champaign This course mainly focuses on Income Statement and Statement of Cash Flows, both help you gain a boarder perspective and answer the important question: “How does the company perform?”. This is beginner level course, so only basic line items are introduced: revenue, cost of goods sold,…

Corporate Finance

Time Value of Money Money received or paid at different time is like different currencies. You can’t add it. Money has a time unit. You must convert them to a common unit to aggregate. Typically we refer to time 0 as today on the time line. Get in the habit of placing cash flows on…

Financial Statement: Company Performance

Financial statements are representations or substitute attributes meant to measure attributes of a company. Income Statement Balance sheet is like a photograph taken on a particularly date. Meanwhile income statement depicts what occurred during the period that changed the company’s position from the beginning of the period to its position at the end of the…