Financial Engineering and Risk Management Part I

Columbia University

An amazing course from a prestigious university! This course touches the hard core of various financial concepts by deriving numerous math equations. It effectively demonstrated why Financial Engineering is a multidisciplinary field drawing from economics, statistics, and engineering.

It usually costs me a few hours to fully digest a 10-minute course video. I have to understand the concepts, derive the equations, use Excel to calculate and verify the result, only then I can pass the exams and have confidence that I truly grasp the mechanism how a certain financial instrument works.

This course covers numerous contents. It started from the very beginning concept named no-arbitrage and fixed-income securities, which are the cornerstone of all further studying. Then the course moves to derivative securities, elaborating swaps, options, forwards, and futures. I love this part because I started feeling “dizzy”. ?

Next the course made enormous effort (almost half of the entire course) on Binomial Model and Term Structure Models and calibrating these models using Excel, which I believe are the most critical and important. They are actually making the connection with machine learning, and brightening the career path of working as a quant.

Lastly, the course covers credit derivatives (like Credit Default Swap) and mortgage backed securities. These topics are easy, but only if you have fully grasped the knowledge you learnt in previous course modules.

I highly recommend this course to those who are interested in Financial Engineering, if you can survive this course, you are good to go.

Quick Recap

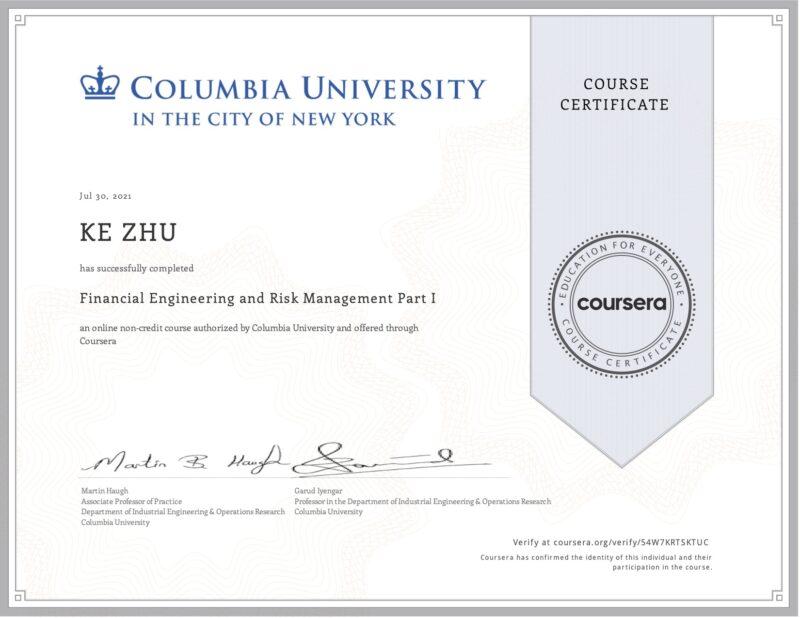

My Certificate

https://coursera.org/share/562767ffd303c5182864b0010ee7f60c

I am Kesler Zhu, thank you for visiting my website. Checkout more course reviews at https://KZHU.ai