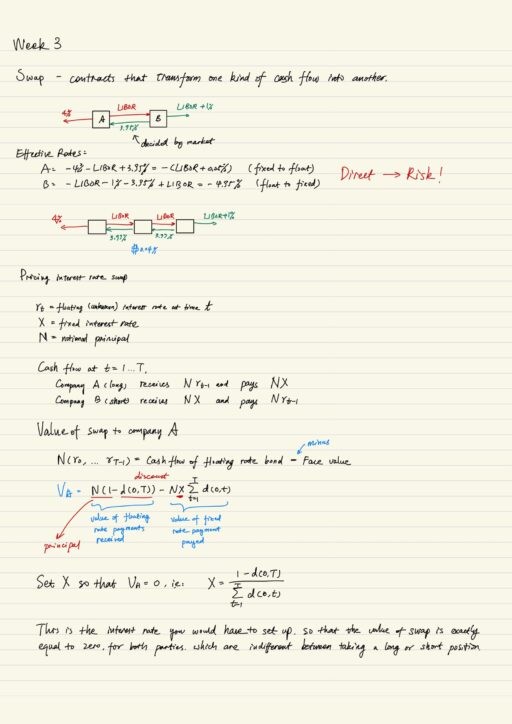

Swaps

Why do companies or entities construct swaps? Because they want to change the nature of cash flows, or leverage strengths in different markets. But there is an implicit assumption that the companies / entities continue to exist. If one of them were to default, it will expose the counter party to a big risk. So most of the time, you don’t make a swap with a counter party directly, instead make it with an intermediary which guarantees the cash flow. The financial intermediary receives a few base points from both parties as compensation for taking on the counter party risk.

Futures

Recall another similar concept: forward contract. The problem with forward contracts are that they are a multitude of prices. As a result, forward contracts can be difficult to set up and organize through an exchange, and there is lack of price transparency. Futures contracts solves the problem – there is a single price for a single maturity, and it can be written on any underlying security with a settlement price.

In order to price futures, we need Martingale Pricing Formalism. Because the interest rates are random, which is not suitable for using the simple arbitrage arguments to construct a price for the future. If the interest rate were deterministic, forward price is equal to the futures price. Then we know how to price the futures price, by constructing the forward price. Meanwhile one thing is sure: the futures price is equal to the price of the underlying security at maturity.

Hedging using futures. In the perfect situation, it would appear by not putting up any money, you were able to fix the price. But in reality you had to put money into a margin account.

Perfect hedges are not always possible. The difference between the spot price for the underlying and the futures price is called the basis. The basis = 0 when there is a perfect hedge. Basis risk arises because the futures contract is on a related but different asset (e.g buy soybean features to hedge kidney beans), or expires at a different time.

Basis risk always happens when we have to hedge using a future contract written on some other underlying. Perfect hedge is impossible. We can try to minimize the variance of the cash flow. Then by taking derivative of the variance, we can get the amount of futures needed to give us minimum variance hedge.

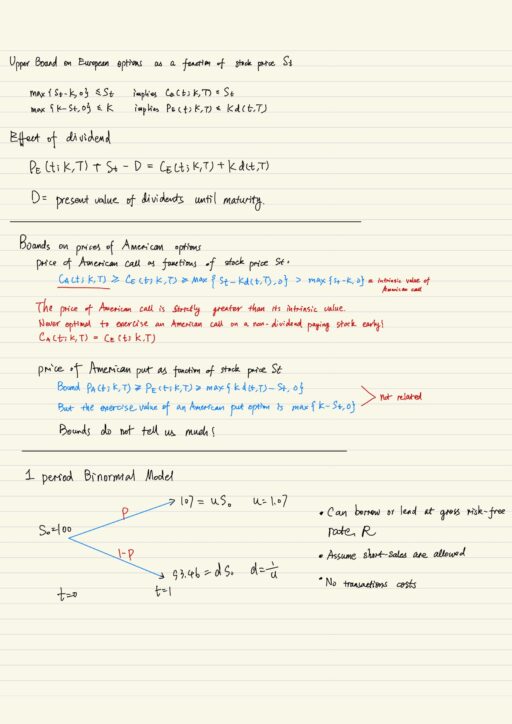

Options

A call gives the buyer the right, but not the obligation to buy. A put gives buyer the right, but not the obligation to sell. European options can be exercised at specified time, but American options can be exercised at any time point till a specified time.

Payoff of a European call option at expiration T is max{ST – K, 0}, which is non-linear in the spot price ST. Similarly, put option is max{K – ST, 0}. Because of the nonlinear payoff, we can’t price without a model for the underlying.

Price of option can be express like this: <Put / Call><European / American>(t; K, T). t is time, K is strike price, T is expiration time. We can construct put-call parity which stands for the fact that put price and call price for a European option have related to each other, e.g.: European put-call parity at time t for non-dividend paying stocks.

We can also use put-call parity to connect price of European and American style options. The price of American options (which offers more choices) is usually greater than that of European options. Lower and upper bounds of price of European options is useful to compute an optimal strategy of execution.

When constructing bounds of price of American options, then get an interesting conclusion. The price of American call is strictly greater than its intrinsic value. It is never optimal to exercise an American call on a non-dividend paying stock early. Price of American call is actually equal to that of European call. But these bounds do not tell much about American put options.

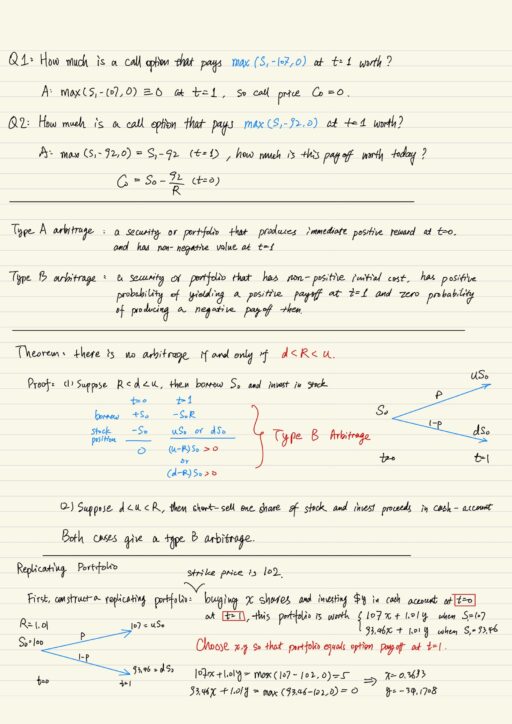

Option Pricing and 1-Period Binomial Model

The St. Petersberg Paradox demonstrates that the fair value of a security should not necessarily be its expected payoff. Daniel Bernouilli resolved this paradox by introducing a utility function. Utility function u(x) measures how much utility of benefit you obtain from x units of wealth. And different people have different utility functions. The function should be increasing and concave.

The great advantage of using 1-period binomial model is that it easily extends to pricing options in the multi-period binomial model. Weak and strong arbitrage applied in deterministic world, we need more general definitions when we introduce randomness. So we have Type A arbitrage (like you find money in the street) and Type B arbitrage (like someone offer you a lottery ticket). These can prove an important theorem: “there is no arbitrage if and only if d < R < u.”

The idea of Replicating Portfolio is extremely important in finance and derivatives. We can construct a replicating portfolio by choosing x shares and $y such at the portfolio equals option payoff at a specified time.

- Positive x means purchasing shares; negative means short-selling

- Positive y means lending cash (investing in cash account); negative means borrowing money.

We want to compute the fair value (or the arbitrage-free price) of a derivative security C0, which actually is 1 / R (discount) multiplied by the expectation value of payoff of the derivative C1, under risk-neutral probabilities. C0 then is called risk-neutral price. Finally we get the crazy conclusion: the true value of the derivative security depends on R, u, and d; it does NOT depend on the true probabilities p!

My Certificate

For more on derivatives securities: swaps, futures and options, please refer to the wonderful course here https://www.coursera.org/learn/financial-engineering-1

Related Quick Recap

I am Kesler Zhu, thank you for visiting. Check out all of my course reviews at https://KZHU.ai