Financial Engineering and Risk Management Part IIColumbia University I am thrilled to complete this wonderful course. Assuming you have fully comprehended the content in its preceding course, this one scuba-dives and show you the incredible underwater world. The underwater voyage starts from the assets and portfolios, you will find an amazing elaboration of Efficient Frontier,…

Tag: Garud Iyengar

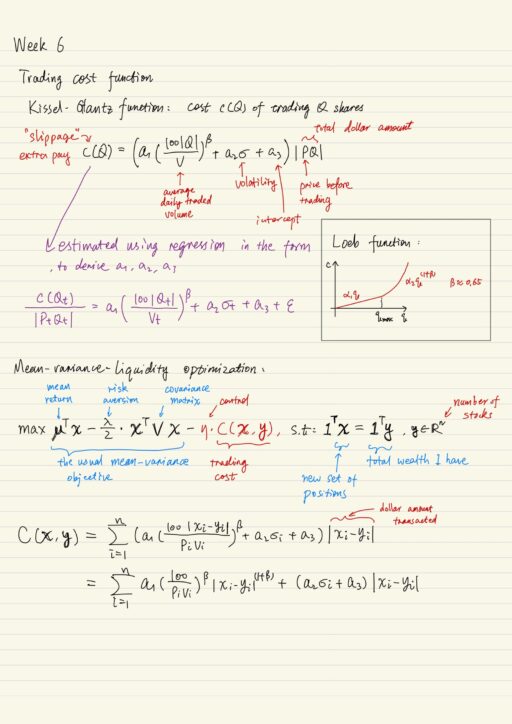

Liquidity, Portfolio Execution, Real Options

Liquidity What is Liquidity and what is a liquidity security is very hard to define in practice. Liquid security can be traded very quickly (quick execution), has very little price impact (low slippage), can be bought and sold in large quantities (deep order book). There are 2 ways to measure liquidity: Trading cost function which…

Credit Derivatives and Structured Products

Securitization Securitization is the process of constructing new securities from the cash flows generated by a pool of underlying securities. The economic rationale behind securitization is that it enables the construction of new securities with a broad range of risk profiles. A board range of investors may therefore be interested in these new securities even…

Risk Management: Equity Derivatives in Practice

Review of Self-Financing Trading Strategy A self-financing trading strategy is a trading strategy θt = (xt, yt) where changes in Vt are due entirely to trading gains or losses, rather than the addition or withdrawal of cash funds. Why do we care? Dynamic Replication: in the multi-period binomial model, we can actually construct a self-financing…

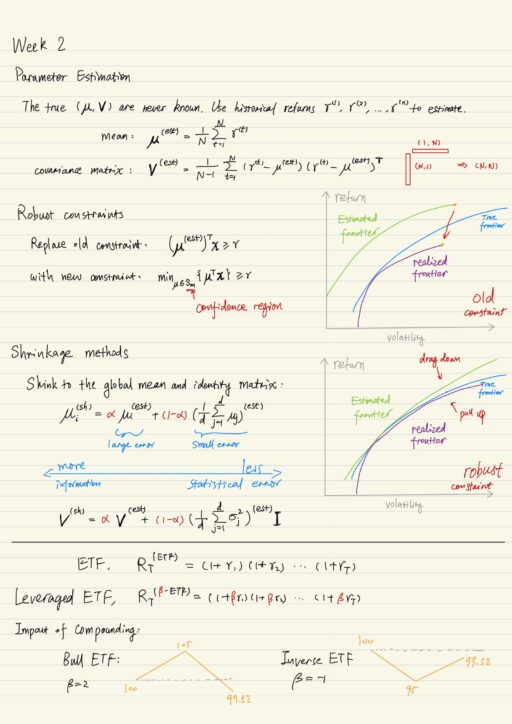

Financial Engineering: Implementing Mean-Variance

There are many aspects of implementation details of mean-variance. 3 of them are the most important. Parameter estimation The estimated mean can be very far away from the true mean. True mean can lie in an ellipse with a certain probability. Parameter error is usually very serious for mean-variance portfolio selection. There is usually a…

Assets & Portfolios: Mean-Variance Optimization

Assets and Portfolios I’ve got a certain amount of money, I want to split it among various assets available for investment. An asset can be characterized by price and return, both of them are random. wi is the amount of money in asset i; wi > 0 means long investment, wi < 0 means short…

My #64 course certificate from Coursera

Financial Engineering and Risk Management Part IColumbia University An amazing course from a prestigious university! This course touches the hard core of various financial concepts by deriving numerous math equations. It effectively demonstrated why Financial Engineering is a multidisciplinary field drawing from economics, statistics, and engineering. It usually costs me a few hours to fully…

Mortgage Backed Securities

Mortgage based securities are a particular kind of asset-based securities. They are asset-backed by underlying pools of securities like mortgage, auto / student loans, credit card receivable, and so on. The process by which asset-based or mortgage-based securities are created is called securitization. By securitizing, we enable the sharing and spreading of risk. There are…

Pricing Defaultable Bonds and Credit Default Swap

Defaultable Bonds A defaultable bond has these characters: We have to specify the probability of default by working directly with risk-neutral probability Q. We will model the term structure of default using 1-step default probability h(t). As with other fixed income securities, we are going to calibrate h(t) to market prices. We will need to…

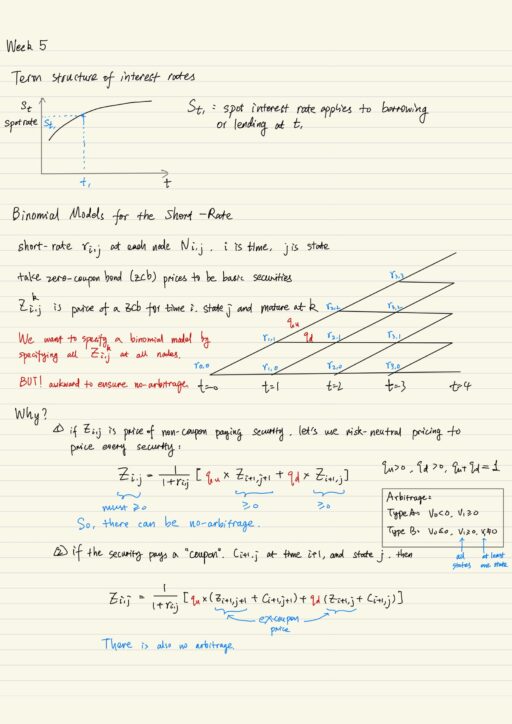

Financial Engineering: Term Structure Models

Fixed Income Derivatives Fixed income markets are enormous and in fact bigger than equity markets. Fixed income derivative markets are also enormous, including: Fixed income models are inherently more complex than security models, because it needs to model evolution of entire term-structure of interest rates. One of the classic ways to get around this problem…

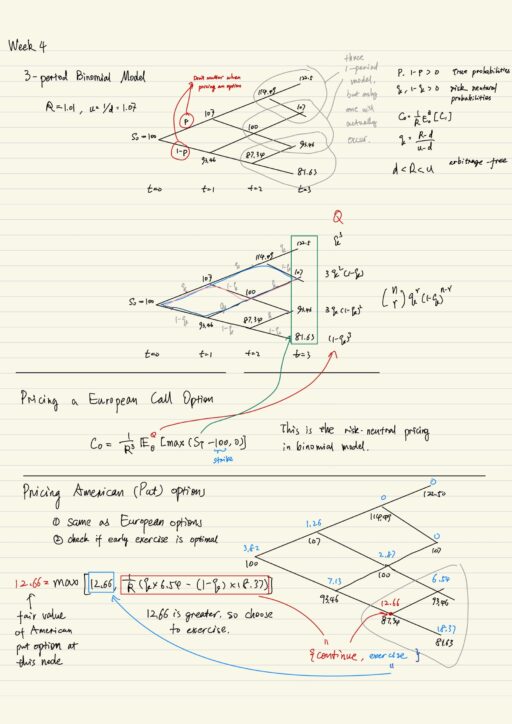

Multi-Period Binomial Model

Multi-period binomial model Multi-period binomial model is really just a series of one-period model spliced together. When pricing an European option, you can calculate it backward 1 period at a time. But you may also do the same thing just as one calculation. It appears the true probabilities p (price going up) and 1-p (price…

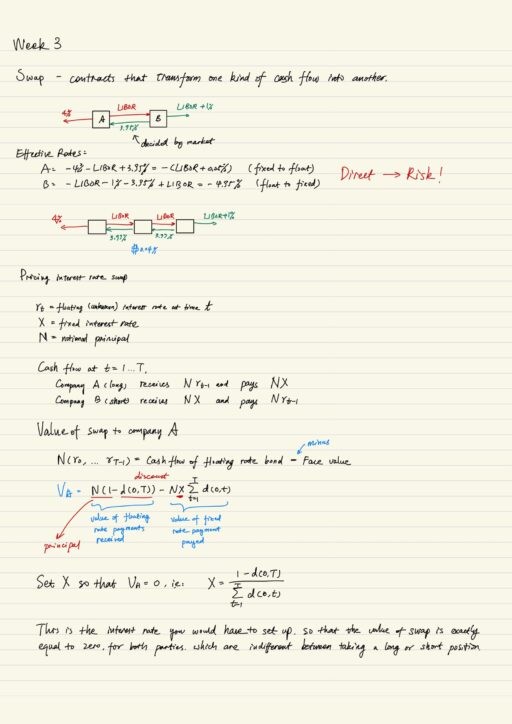

Derivative Securities: Swaps, Futures and Options

Swaps Why do companies or entities construct swaps? Because they want to change the nature of cash flows, or leverage strengths in different markets. But there is an implicit assumption that the companies / entities continue to exist. If one of them were to default, it will expose the counter party to a big risk….