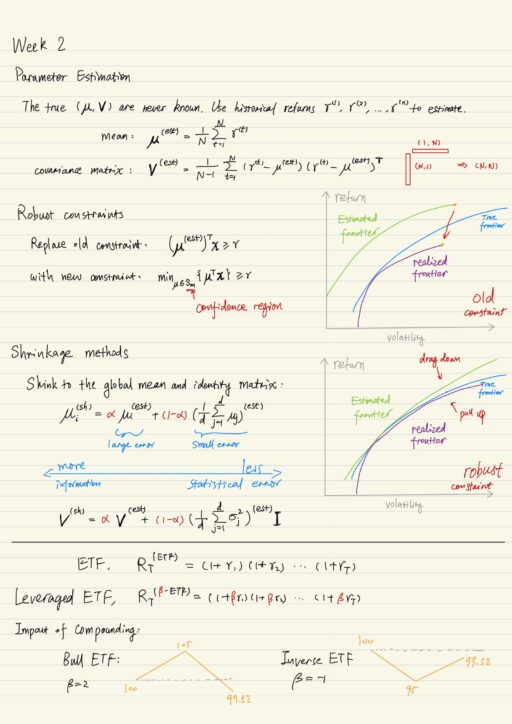

There are many aspects of implementation details of mean-variance. 3 of them are the most important. Parameter estimation The estimated mean can be very far away from the true mean. True mean can lie in an ellipse with a certain probability. Parameter error is usually very serious for mean-variance portfolio selection. There is usually a…

Everyday Leadership

What is Leadership Leadership is not just about formal authority, it is really about influencing others. Today’s business environment is fast – things happen very quickly, you have to react quickly. Technology has made it faster to connect to people anywhere in the world, that can bring customers but also competitors. Agility is a social…

Introducing Operations Research

Motivations Management is the attainment of organizational goals in an effective and efficient manners through planning, organizing, leading, and controlling organizational resources. Daft R. L. (2014) Management When you run a company or an organization, you want to do something, that is your goal, but you have limited resources, you want to assign or allocate…

Assets & Portfolios: Mean-Variance Optimization

Assets and Portfolios I’ve got a certain amount of money, I want to split it among various assets available for investment. An asset can be characterized by price and return, both of them are random. wi is the amount of money in asset i; wi > 0 means long investment, wi < 0 means short…

Corporate Strategy: Sum-of-the-Parts Analysis

What is Corporate Strategy? Corporate strategy is strategy that firms use to compete across multiple businesses. It is relevant for 2 groups of firms: multi-business firms and single-business firms that think about extending into a new business. Having different strategy for different business is not sufficient. A business vary by both corporation and industry, but…

My #64 course certificate from Coursera

Financial Engineering and Risk Management Part IColumbia University An amazing course from a prestigious university! This course touches the hard core of various financial concepts by deriving numerous math equations. It effectively demonstrated why Financial Engineering is a multidisciplinary field drawing from economics, statistics, and engineering. It usually costs me a few hours to fully…

Mortgage Backed Securities

Mortgage based securities are a particular kind of asset-based securities. They are asset-backed by underlying pools of securities like mortgage, auto / student loans, credit card receivable, and so on. The process by which asset-based or mortgage-based securities are created is called securitization. By securitizing, we enable the sharing and spreading of risk. There are…

My #63 course certificate from Coursera

A Crash Course in Data ScienceJohns Hopkins University As the pilot of the specialization “Executive Data Science”, this very short course provides a bird’s eye view of a few critical aspects for data science. The most impressive to me is the comparison between machine learning and traditional statistics. This is very interesting to realize there…

Data Science for Executives

Data science is only useful when the data are used to answer a specific, concrete question that could be useful for your organization. Data science is the process of: There is actually data science learning from data, discovering what is the right prediction model is. And there is implementation lumped into data engineering to scale…

Pricing Defaultable Bonds and Credit Default Swap

Defaultable Bonds A defaultable bond has these characters: We have to specify the probability of default by working directly with risk-neutral probability Q. We will model the term structure of default using 1-step default probability h(t). As with other fixed income securities, we are going to calibrate h(t) to market prices. We will need to…

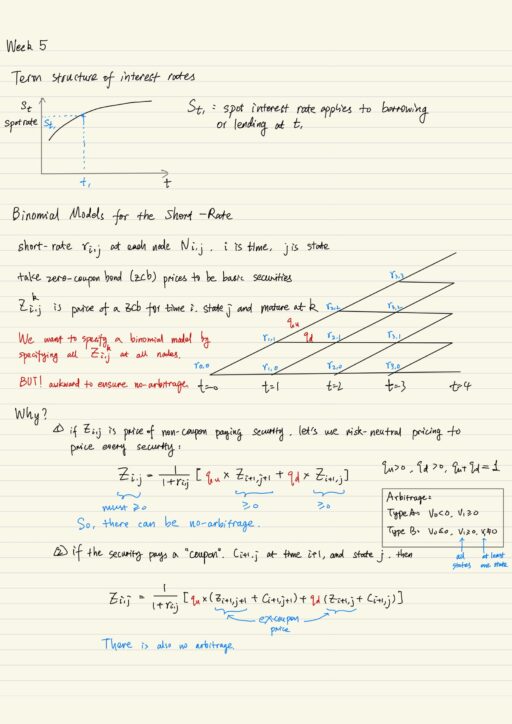

Financial Engineering: Term Structure Models

Fixed Income Derivatives Fixed income markets are enormous and in fact bigger than equity markets. Fixed income derivative markets are also enormous, including: Fixed income models are inherently more complex than security models, because it needs to model evolution of entire term-structure of interest rates. One of the classic ways to get around this problem…

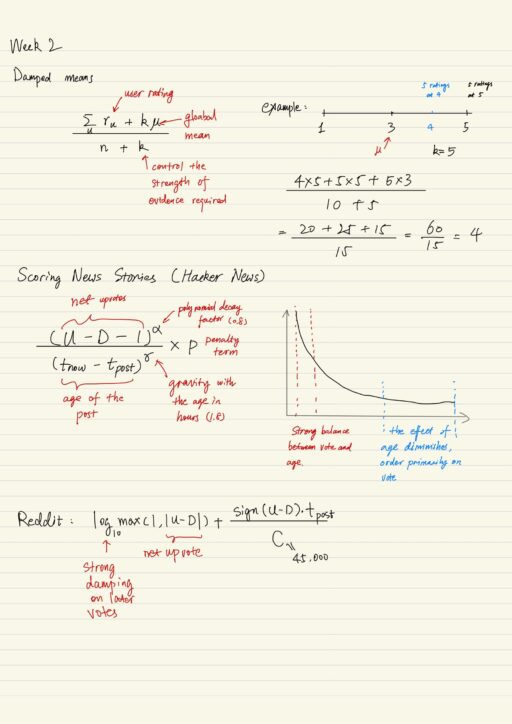

Non-personalized Recommenders

Non-personalized recommenders systems are remarkably effective tools and still useful in various situations. For example: recommendation in print for restaurants. Sometimes we know a little about users: age, gender, zip code. We can do a little week personalization. Also product associations allow recommendations based on current page, item, or context. Summary Statistics This is a…

My #62 course certificate from Coursera

Contracts & Employment LawUniversity of Illinois at Urbana-Champaign This is a very useful course for non-experts, because we all do business every day. The course firstly introduced all elements of a valid contract, a little theoretical, but instructive to help identify the reasons why an agreement is not enforceable. Besides rules from common law, the…

Agency and Employment Law

Agency Agency is nothing more than the idea that you give somebody else authority to act on your behave. There is a principal (the person in charge) and an agent (who takes on some responsibility from the principal). There are 4 types of common agency relationship: Agent’s Duties Agent’s Rights Principal’s Duties Principle’s Rights Tort…

Introducing Recommender Systems

Information Retrieval and Filtering Information retrieval evolved in response to the need to be able to ask questions about a large collection of documents. We have a static content base, and there is dynamic information need (a query). So we spend our time and invest in indexing the content base. The common approach used is…