My #70 course certificate from Coursera

Understanding Financial Statements: Company PositionUniversity of Illinois at Urbana-Champaign This is a beginner-level course about financial statements, particularly...

My #69 course certificate from Coursera

Financial Engineering and Risk Management Part IIColumbia University I am thrilled to complete this wonderful course. Assuming you...

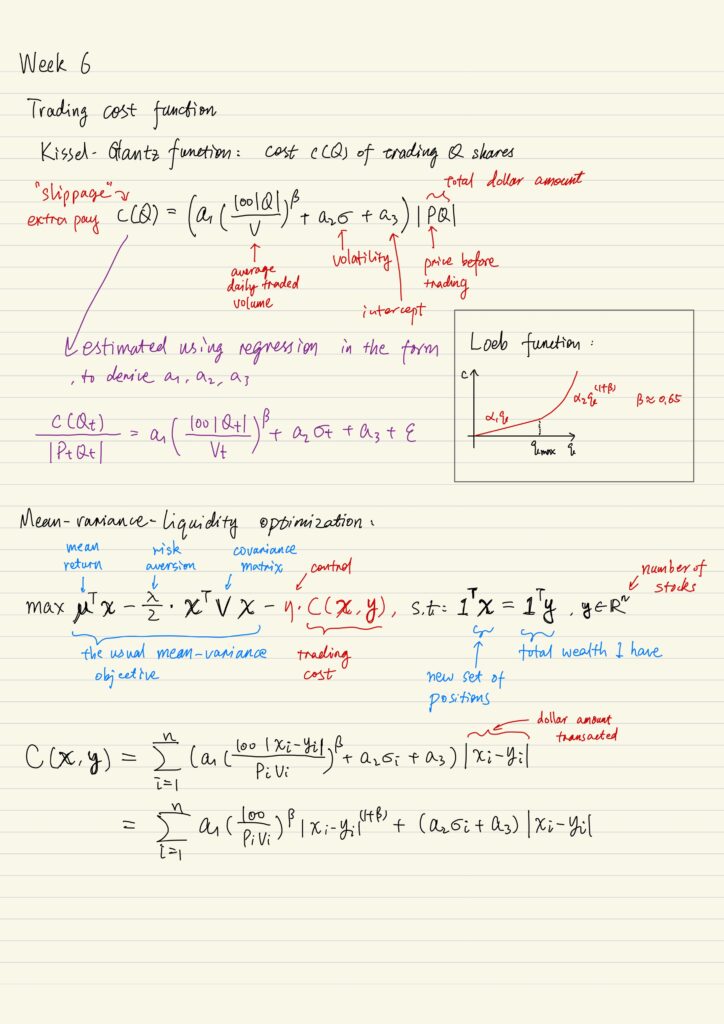

Liquidity, Portfolio Execution, Real Options

Liquidity What is Liquidity and what is a liquidity security is very hard to define in practice. Liquid...

Financial Statement: Company Position

The financial statements are a manifestation of accounting, which is what we use to prepare proper financial statements....

Financial Markets Week 2

It takes long for ideas to develop. We might be excessively fearful or unwillingly to change. Risk management...

Credit Derivatives and Structured Products

Securitization Securitization is the process of constructing new securities from the cash flows generated by a pool of...

Risk Management: Equity Derivatives in Practice

Review of Self-Financing Trading Strategy A self-financing trading strategy is a trading strategy θt = (xt, yt) where...

Financial Markets Week 1

Measure of Risks VAR means variance. The variance of a portfolio is defined as a measure of its...

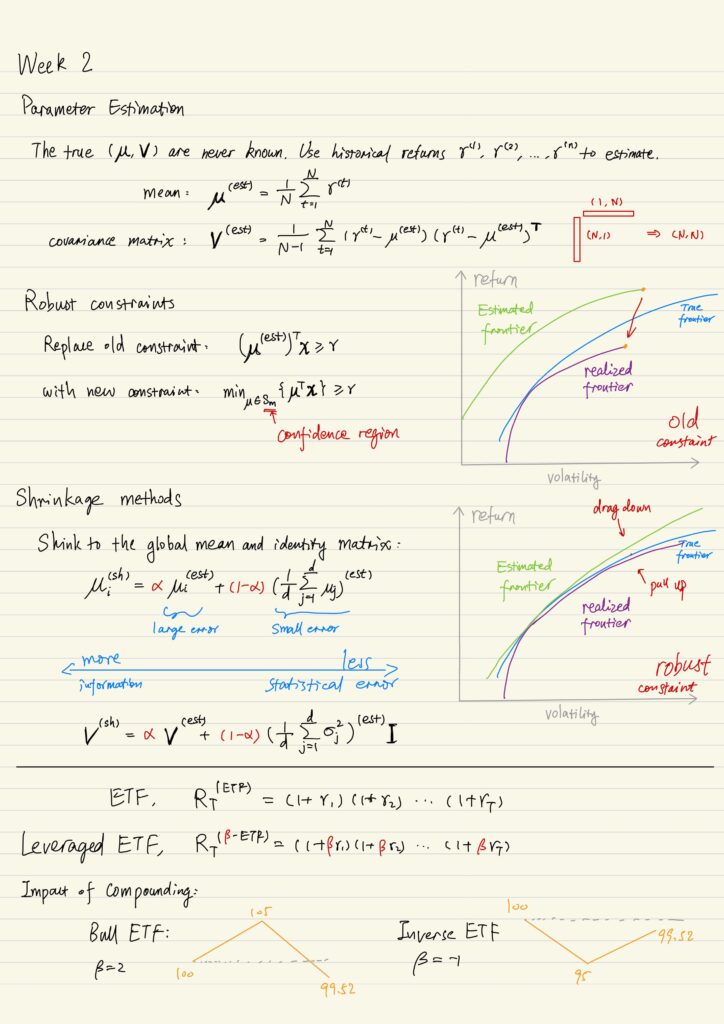

Financial Engineering: Implementing Mean-Variance

There are many aspects of implementation details of mean-variance. 3 of them are the most important. Parameter estimation...

Assets & Portfolios: Mean-Variance Optimization

Assets and Portfolios I’ve got a certain amount of money, I want to split it among various assets...

My #64 course certificate from Coursera

Financial Engineering and Risk Management Part IColumbia University An amazing course from a prestigious university! This course touches...

Mortgage Backed Securities

Mortgage based securities are a particular kind of asset-based securities. They are asset-backed by underlying pools of securities...

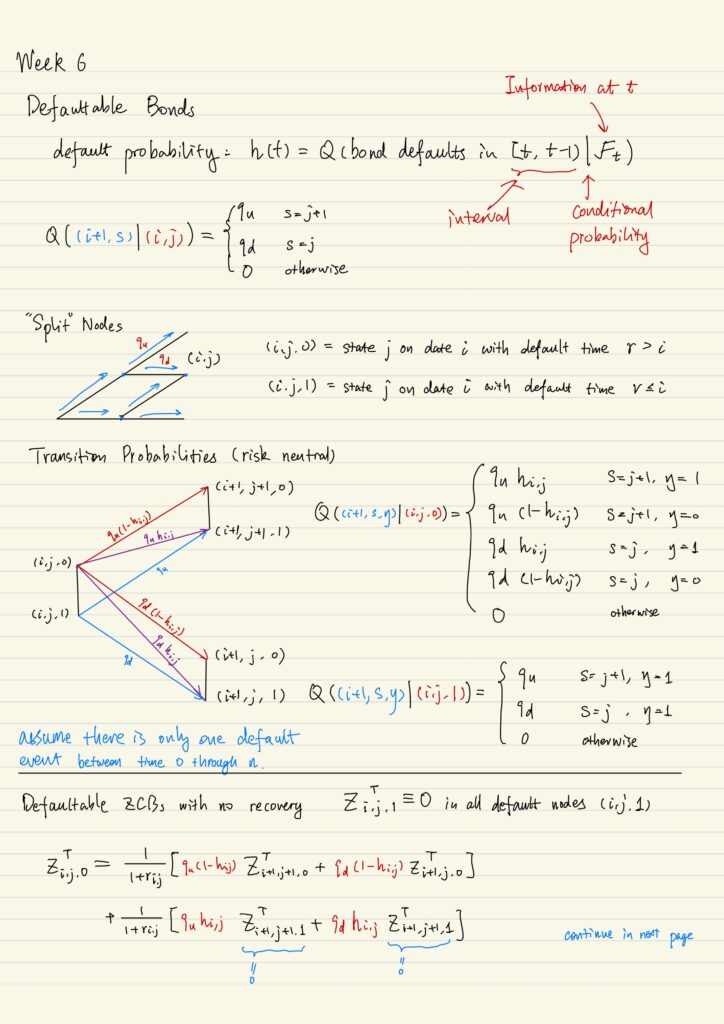

Pricing Defaultable Bonds and Credit Default Swap

Defaultable Bonds A defaultable bond has these characters: We have to specify the probability of default by working...

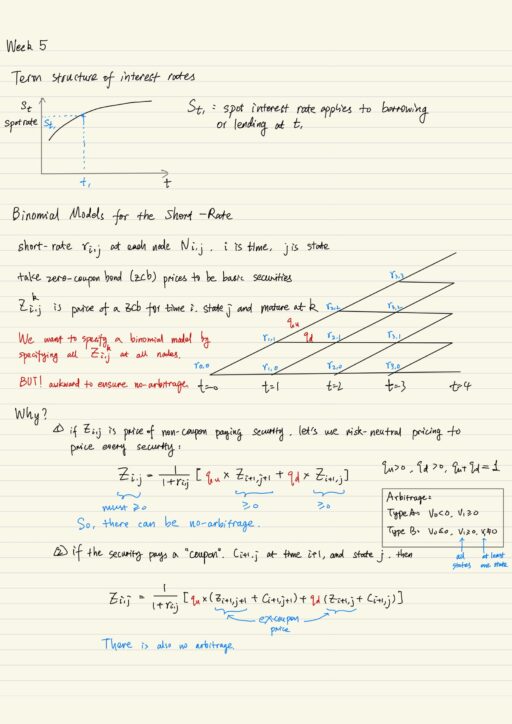

Financial Engineering: Term Structure Models

Fixed Income Derivatives Fixed income markets are enormous and in fact bigger than equity markets. Fixed income derivative...

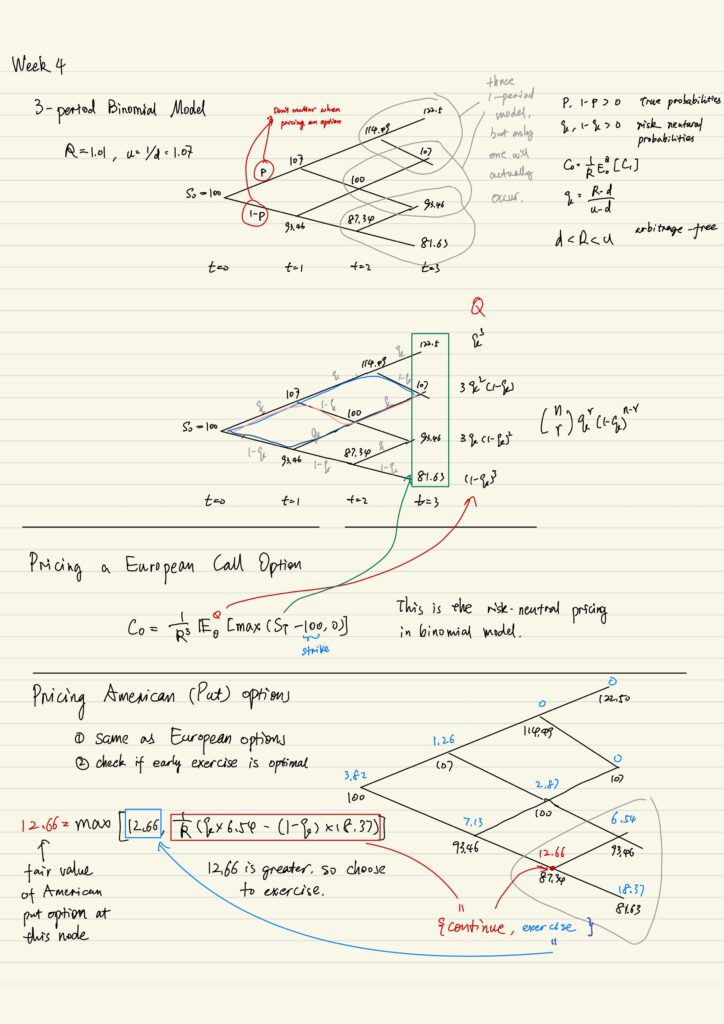

Multi-Period Binomial Model

Multi-period binomial model Multi-period binomial model is really just a series of one-period model spliced together. When pricing...