My #69 course certificate from Coursera

Financial Engineering and Risk Management Part IIColumbia University I am thrilled to complete this wonderful course. Assuming you...

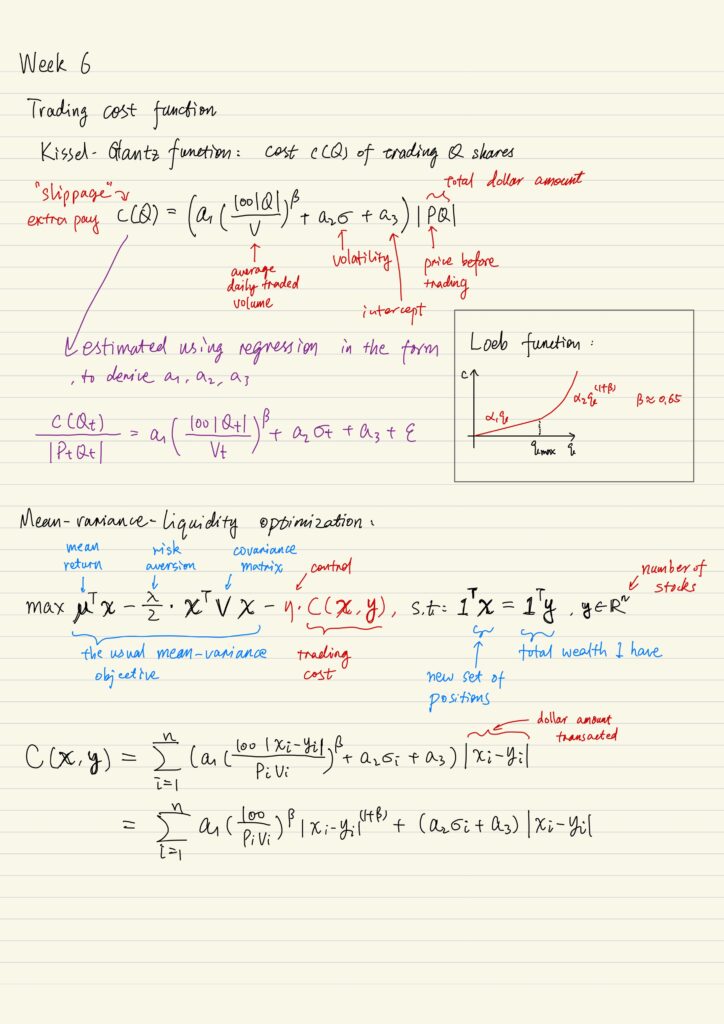

Liquidity, Portfolio Execution, Real Options

Liquidity What is Liquidity and what is a liquidity security is very hard to define in practice. Liquid...

Credit Derivatives and Structured Products

Securitization Securitization is the process of constructing new securities from the cash flows generated by a pool of...

Risk Management: Equity Derivatives in Practice

Review of Self-Financing Trading Strategy A self-financing trading strategy is a trading strategy θt = (xt, yt) where...

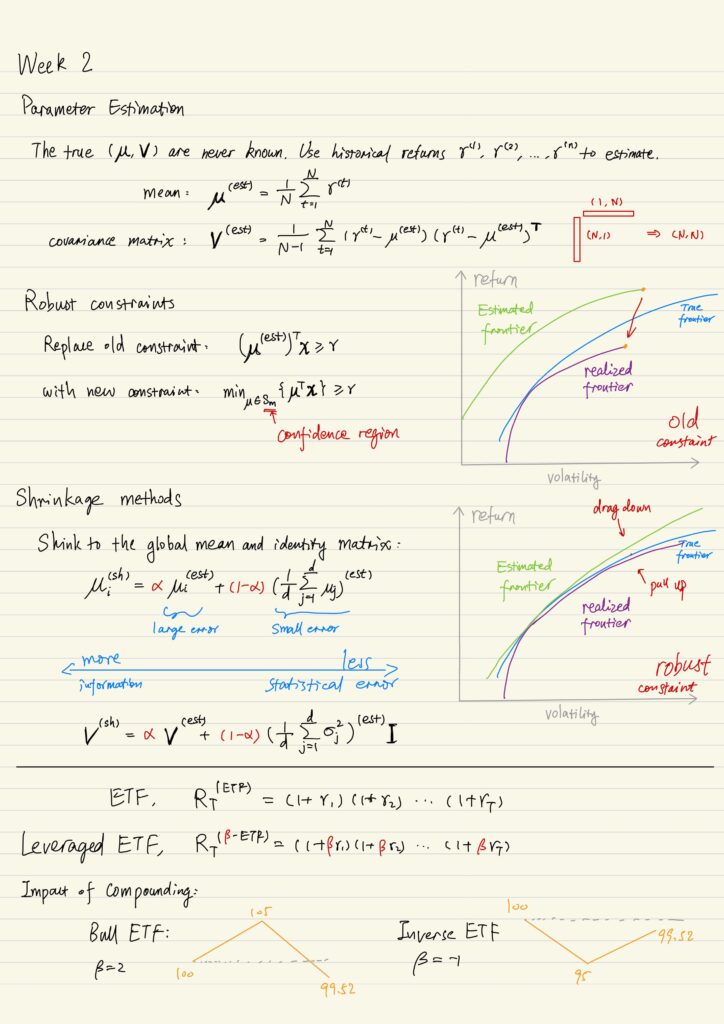

Financial Engineering: Implementing Mean-Variance

There are many aspects of implementation details of mean-variance. 3 of them are the most important. Parameter estimation...

Assets & Portfolios: Mean-Variance Optimization

Assets and Portfolios I’ve got a certain amount of money, I want to split it among various assets...

My #64 course certificate from Coursera

Financial Engineering and Risk Management Part IColumbia University An amazing course from a prestigious university! This course touches...

Mortgage Backed Securities

Mortgage based securities are a particular kind of asset-based securities. They are asset-backed by underlying pools of securities...

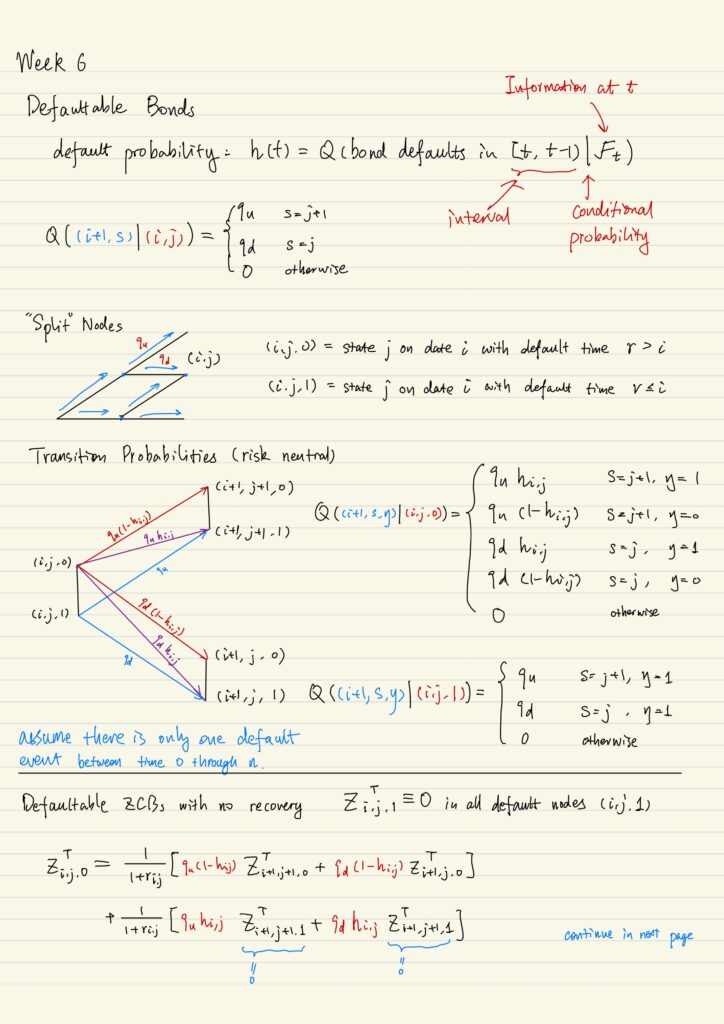

Pricing Defaultable Bonds and Credit Default Swap

Defaultable Bonds A defaultable bond has these characters: We have to specify the probability of default by working...

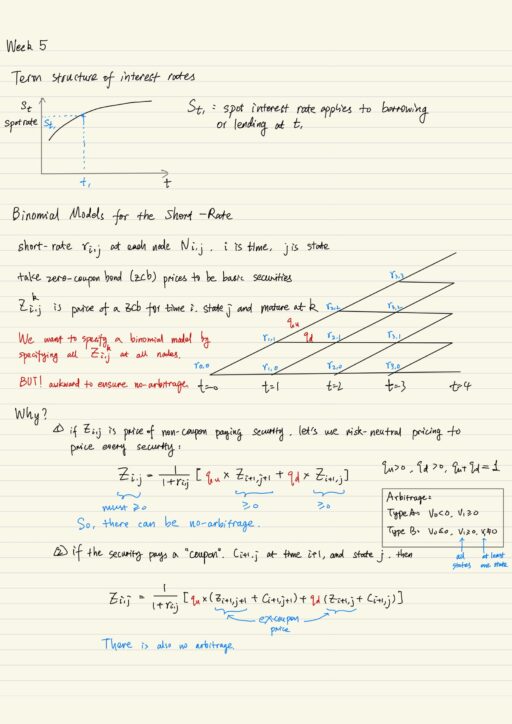

Financial Engineering: Term Structure Models

Fixed Income Derivatives Fixed income markets are enormous and in fact bigger than equity markets. Fixed income derivative...

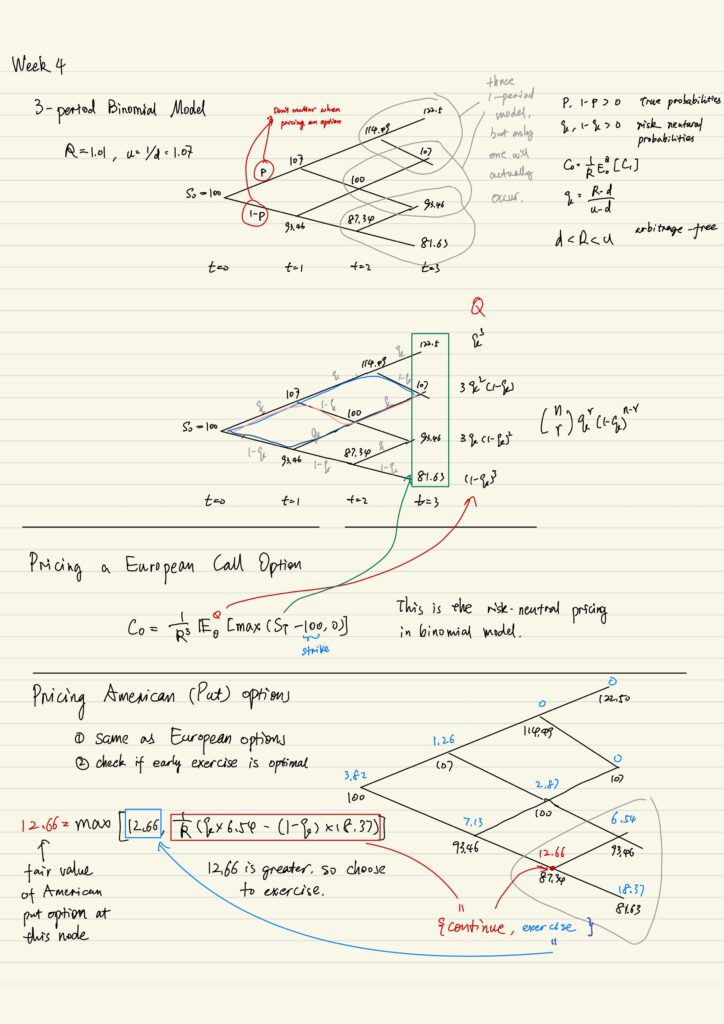

Multi-Period Binomial Model

Multi-period binomial model Multi-period binomial model is really just a series of one-period model spliced together. When pricing...

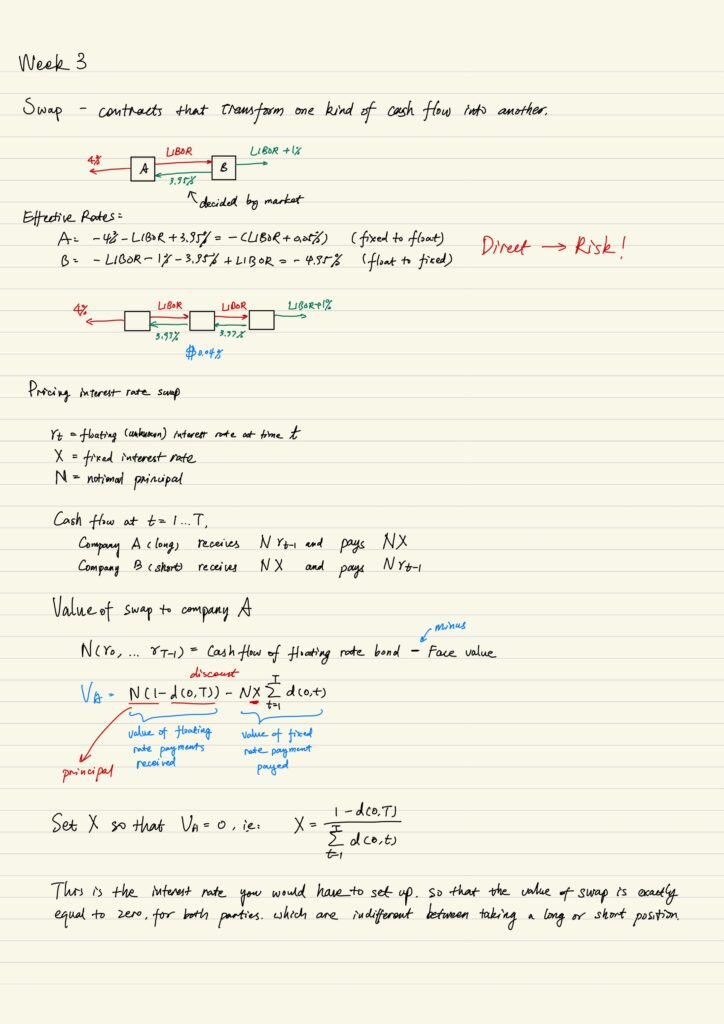

Derivative Securities: Swaps, Futures and Options

Swaps Why do companies or entities construct swaps? Because they want to change the nature of cash flows,...